Investors Moderately Confident About Retirement Savings

Thursday, April 30th, 2015

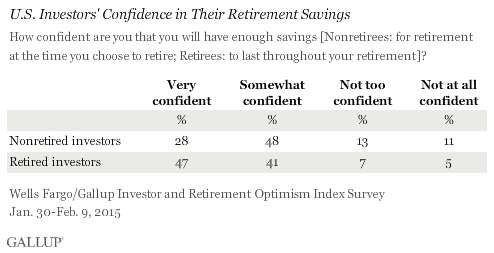

Most U.S. investors are generally confident they are financially prepared for retirement, including 88% of retired investors and 76% of nonretired investors. However, less than half (47%) of retired investors are "very" confident they have enough savings to last throughout their retirement, while even fewer nonretired investors, 28%, are very confident they will have saved enough by the time they retire.

These findings are from the Wells Fargo/Gallup Investor and Retirement Optimism Index survey for the first quarter of 2015, conducted Jan. 30-Feb. 9. The Wells Fargo/Gallup survey defines investors as U.S. adults in households with at least $10,000 invested in stocks, bonds or mutual funds. Approximately 40% of U.S. adults meet these criteria.

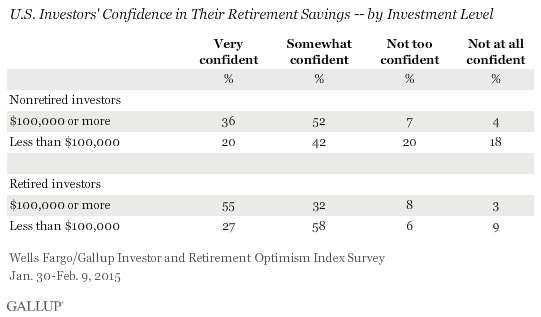

Among nonretired investors, those with $100,000 or more invested are a bit more optimistic about their future retirement security than those with less than $100,000 invested: 36% in the high-asset group feel very confident they will have saved enough, versus 20% of those with less invested. However, the confidence gap by investor assets widens considerably among retirees. More than half (55%) of retired investors with at least $100,000 in investments are very confident about their savings lasting, compared with a quarter (27%) of those with less than $100,000.

The survey finds little difference in confidence about their future retirement security between nonretired men and nonretired women: 30% vs. 25%, respectively, are very confident. At the same time, there is a sizable gender difference among retired investors. Fifty-five percent of male retired investors are very confident they will have enough savings to last throughout retirement, compared with 37% of female retired investors.

Younger Nonretired Investors Need Most Help Picking the Right Investments

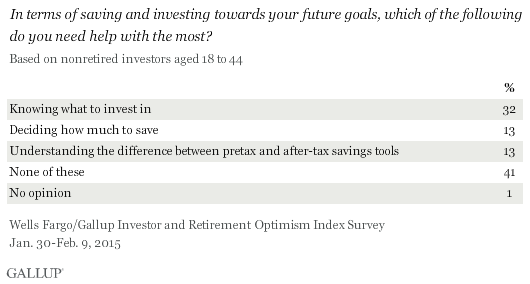

The survey also asked nonretirees aged 18 to 44 -- those in the early and middle stages of saving for retirement -- to say which of three retirement savings issues they could use the most help with. "Knowing what to invest in" emerged as the clear leader, cited by 32% of respondents. Thirteen percent chose deciding how much to save, and another 13% chose understanding the difference between pretax and after-tax savings tools. The plurality, 41%, said they do not need help with any of these aspects of saving.

Older Investors Focused on Making Retirement Savings Last, Paying for Healthcare

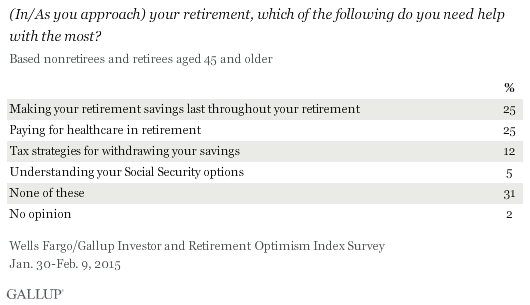

Gallup presented a different set of retirement issues to investors 45 and older -- including nonretirees and retirees. When asked which of four issues they need help with the most, 25% each picked making their savings last throughout retirement and paying for healthcare in retirement. About half as many (12%) said they most need help in understanding tax strategies for withdrawing their savings, and 5% chose understanding their Social Security options. Three in 10 said they don't need help with any of these issues.

Bottom Line

Most U.S. investors are broadly confident they have amassed enough savings to get them through their retirement years, but with the exception of retirees with $100,000 or more in assets and retired men, relatively few truly feel secure. This is especially notable, given that people who are defined as investors for this poll -- those who meet the minimum threshold of $10,000 in savings -- are almost certainly better prepared for retirement than people with even fewer, or no, investments to speak of.

Investors' less than complete confidence in their retirement security may stem partly from uncertainty about things beyond their control, such as the economy, market stability and major health problems arising. Part, however, may result from a belief that they aren't saving enough or haven't developed a clear retirement plan. While there is no substitute for disciplined savings, younger investors might develop more confidence by seeking expert advice to help ensure they are investing in the right places, while older investors might rest easier with professional guidance in how to make their savings last, taking potential healthcare expenses into account.