Number of Bank Account Owners Worldwide Grows by 700 Million

Jan Sonnenschein, Peter van Oudheusden

Monday, April 20th, 2015

Access to financial services and products has expanded rapidly across the globe in the past few years. The number of adults worldwide who report having an account at a formal financial institution or through a mobile device grew by an estimated 700 million between 2011 and 2014. Now, 62% of the world's adult population has an account, which is up from 51% in 2011.

These results come from the 2014 Global Financial Inclusion (Global Findex) database, which measures the extent of account penetration, the use of mobile money payments and saving and borrowing practices in more than 140 countries. It updates the original Global Findex, which the World Bank launched in 2011 in cooperation with Gallup, and is funded by the Bill & Melinda Gates Foundation.

Developing World Catching Up

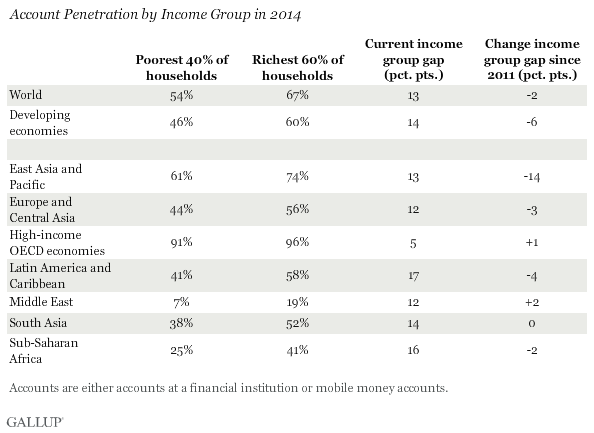

Account penetration -- defined as having an account at a formal financial institution or a mobile money account -- remains highly unequal across regions. It is almost universal in high-income Organization for Economic Cooperation and Development (OECD) economies (94%), while slightly more than half of adults (54%) in developing economies have an account. Although many adults in developing economies remain excluded from the formal financial system, there is good news: Account penetration in the developing world is up 13 percentage points from 41% in 2011.

In fact, account penetration has increased across all world regions. However, the extent of the increase varies widely from 14 points in both South Asia and East Asia and the Pacific to eight and four points in sub-Saharan Africa and high-income OECD economies, respectively.

Accounts at financial institutions drove the increase in account penetration in all regions except sub-Saharan Africa, where almost one-third of account holders dial into the financial system using mobile money accounts. The rising popularity of these accounts helped push overall account penetration in the region to 34%, up from 24% in 2011. Outside sub-Saharan Africa, use of mobile money accounts remains limited, reported by 3% of adults in South Asia, 2% in Latin America and the Caribbean, and less than 1% in all other regions.

The Unbanked Concentrated in Asia and Sub-Saharan Africa Regions

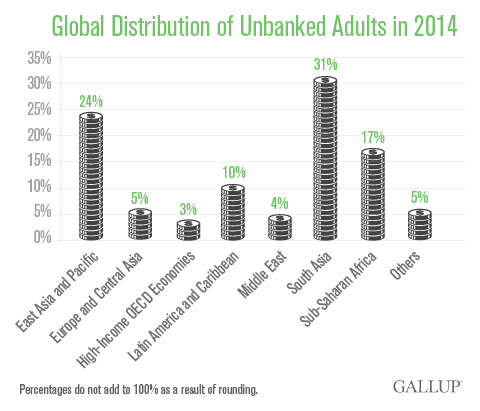

South Asia and East Asia and the Pacific are home to about half of the world's 2 billion "unbanked" adults. In South Asia, about 625 million adults lack account access, and the same is true for about 490 million adults in East Asia and the Pacific. India, China and Indonesia alone account for 38% of unbanked adults globally. Sub-Saharan Africa has the next-largest population of unbanked adults, at about 350 million -- or 17% of the global total.

The Unbanked Disproportionately Poor and Female

Despite recent global growth, the gender gap in account ownership has not closed. Forty-two percent of women are unbanked, compared with 35% of men. Access to the formal financial system is also stratified by wealth. Half of the unbanked worldwide -- 1 billion adults -- belong to the poorest 40% of households. However, in developing economies, the gap in account ownership between adults living in the poorest 40% of households and those living in the richest 60% narrowed by six points in the past three years. But this decrease stemmed overwhelmingly from rising account ownership among the poor in East Asia and the Pacific; in all other regions, the gap remained about the same.

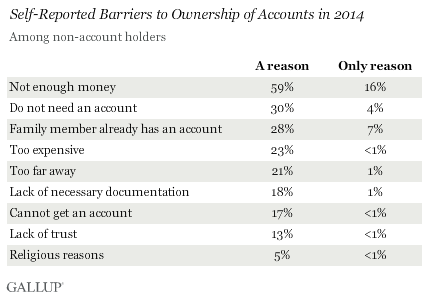

Poverty Cited as Main Reason for Not Owning Account

As in 2011, the most common reason cited for why adults remain unbanked is the lack of money. Fifty-nine percent list poverty as one of the reasons for being unbanked, but only 16% cite it as the sole reason. In all developing regions except Europe and Central Asia, lack of enough money is the most commonly cited reason. It is important to add that just 4% say lack of need is the only reason they do not have an account, underscoring the unmet demand for financial services among the unbanked. Beyond this, the reasons residents are most likely to report vary according to local conditions. In sub-Saharan Africa, distance to financial institutions is the second most commonly reported barrier, cited by 27%. In the Middle East, 41% of adults without an account say they cannot get one. This likely reflects prohibitive costs and documentation requirements for opening an account.

Implications

Three years ago, 2.5 billion adults worldwide were unbanked. Despite the progress since then, 2 billion adults remain excluded from the financial system with unmet needs and untapped market potential. The results from the Global Findex Database reveal who the unbanked are: where they live, how they get by and why they do not have an account. Findings also show that most of the unbanked do want to open an account. With the Global Findex, governments and the private sector can build ways to reach these people -- and further expand financial inclusion.

Two possible avenues to expand financial inclusion are digitizing payments -- wage payments or government transfers -- and formalizing saving practices, which the second article in this series will explore.