As Industry Grows, Percentage of U.S. Sports Fans Steady

Thursday, June 18th, 2015

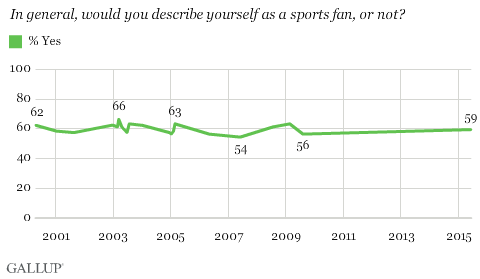

Although the sports industry is continuing its impressive growth, the percentage of Americans who describe themselves as sports fans has stayed relatively stable over time. Currently, 59% of Americans say they are sports fans, one percentage point less than the average in Gallup's trend dating back to 2000.

The latest update, from a June 2-7 poll, came as the FIFA Women's World Cup got underway and during the NHL and NBA championship series.

The sports industry has become one of the bigger industries in the United States, mostly because of increasingly expensive rights fees television networks are paying to broadcast the various leagues' games. But the industry also has benefited from increased revenue from merchandise sales, ticket and luxury suite sales and stadium naming rights.

Gallup's sports fan data have shown some minor variation over the last 15 years, but in general, the trend can be characterized as stable at around 60%. Americans were a bit more likely to identify as sports fans from 2000 through 2004 (averaging 61%) than they have been since 2004 (58%). However, it is unclear if this represents a meaningful decline given Gallup's more limited updates of this question in recent years, as well as the possibility that people's willingness to identify as sports fans may vary depending on the time of the year the question is asked. Specifically, Americans appear to be a bit more likely to say they are sports fans in January through March, during the NFL playoffs and NCAA basketball tournament, than in the other months of the year.

Men, Upper-Income Most Likely to Identify as Sports Fans

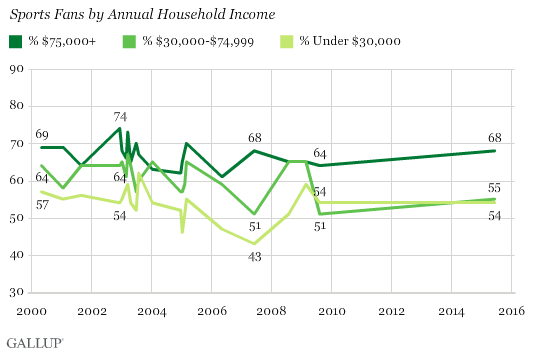

A majority of U.S. adults in each major demographic subgroup say they are sports fans. Not unexpectedly, men (66%) are much more likely to be sports fans than women (51%). But the poll shows large differences by annual household income, with upper-income Americans (68%) significantly more likely to be sports fans than those residing in lower-income (54%) and middle-income (55%) households.

Upper-income Americans have consistently been much more likely than lower-income Americans to identify themselves as sports fans and have been more likely, or just as likely, as middle-income Americans to say they are sports fans.

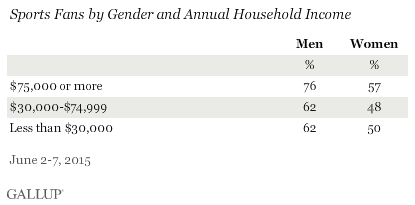

Gender and income each have an independent effect on one's affinity for sports, and the two interact in a way such that upper-income men are especially likely to be sports fans, with 76% saying they are. The effect of income is clear in that upper-income men and women are more likely to be sports fans than their lower- and middle-income counterparts. However, gender appears to have a greater influence than income does, because lower- and middle-income men are more likely than upper-income women to be sports fans.

There are also significant differences by employment status -- 65% of employed Americans are sports fans, compared with 51% who are not currently employed. This is not merely related to the fact that men and upper-income people are more likely to be working -- employment is related to being a sports fan even after taking into account the effects of gender and income. The data show that 70% of working men and 59% of working women are sports fans, compared with 60% of nonworking men and 45% of nonworking women.

Gallup has not consistently asked about employment status in the same polls in which it measures sports fans, but in the few polls that have included both, the relationships have been apparent.

Additional data on the percentage of sports fans by subgroup appear at the end of the article.

Implications

Sports are a major part of U.S. culture, with roughly six in 10 Americans identifying themselves as sports fans. As a result, sports are a big driver of economic activity, and the market for commerce related to sports is enormous. The attractiveness of sports programming to television networks, Internet websites and advertisers is clear, given that upper-income people, particularly upper-income men, are especially likely to be watching or logging on.

But as the sports industry has continued to grow, the percentage of Americans who identify as sports fans has stayed flat. The link between income and being a sports fan may be one of the factors behind the continued growth. Assuming networks and advertisers are aware of the income-sports fan link, the value of upper-income viewers to networks and advertisers would help explain why league broadcast rights fees are growing. Also, upper-income Americans have more discretionary income to spend on tickets, team merchandise and subscriptions to various sports-related packages to further fuel the sports industry's expansion.