Study: How Georgia Ranks in Middle-Class Family Tax Burden Analysis

Friday, July 25th, 2025

Key Highlights for Georgia

-

Effective Tax Rate in Georgia: A household with two adults and two children in Georgia faces an effective tax rate of 13.4%, which ranks 19th among all U.S. states.

-

Georgia’s Total Income Tax Burden: That translates to $13,723 in combined federal and state income taxes on a pre-tax income of $102,427—the income level required for an adequate standard of living, which includes the cost of essentials such as housing, food, transportation, child care, health care, and other necessities, as estimated by the Economic Policy Institute.

-

Georgia Compared to the U.S. Average: For reference, the average middle-class effective tax rate across the U.S. is 13.6%, or $15,522 each year.

With the recent passage of legislation extending key provisions of the Tax Cuts and Jobs Act (TCJA), the debate over who benefits most from the U.S. tax code has once again come into focus. Originally passed in 2017, the TCJA lowered individual tax rates, increased the standard deduction, and expanded the Child Tax Credit—changes that many experts say offer benefits to low- and middle-income families. At the same time, provisions like reduced rates on high incomes, lower corporate taxes, and expanded estate and gift tax exemptions disproportionately favor wealthier Americans, according to analyses from bipartisan sources.

In light of this ongoing policy debate, this analysis conducted by Upgraded Points, a company that provides advice on credit cards rewards programs and other financial products, examines where middle-class families—specifically, 2-parent households with 2 children—face the highest and lowest income tax burdens across the U.S. By comparing the income required to maintain an adequate standard of living in each location to the resulting federal and state taxes, the study highlights where middle-class families are most and least heavily taxed.

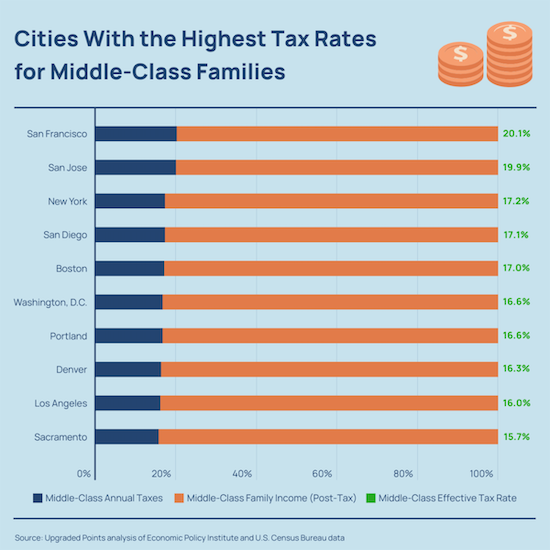

Cities With the Largest Tax Burden

Among the nation’s largest metro areas, San Francisco imposes the greatest income tax burden on middle-class families. A household with 2 adults and 2 children in the San Francisco-Oakland-Fremont area faces an effective tax rate of 20.1%. That translates to $39,285 in combined federal and state income taxes on a pretax income of $195,525, which is the highest income level required for an adequate standard of living in any metro analyzed.

Close behind is San Jose, California, where middle-class families pay 19.9% of their income in taxes. With a required pre-tax income of $192,708 and taxes totaling $38,418, San Jose households face a similarly steep cost of living and tax burden, reflecting the broader financial demands of the high-cost Silicon Valley region.

The New York metro ranks third, with a 17.2% effective tax rate. Families living in and around the Big Apple pay an estimated $25,292 in taxes on pretax incomes of $147,063. Despite a lower income threshold than the Bay Area metros of San Francisco and San Jose, the region’s state and local tax structure contributes to a relatively high burden on middle-income earners.

Rounding out the top 10 are several other high-cost urban areas, including San Diego (17.1%), Boston (17.0%), and Washington, D.C. (16.6%). Portland, Denver, Los Angeles, and Sacramento, California also fall within the top 10, each with effective tax rates between 15.7% and 16.6%. Notably, 5 of the 10 metros with the highest tax burdens are located in California, highlighting the combined effect of elevated living costs and the state’s high taxes.

Cities With the Smallest Tax Burden

San Antonio has the lowest effective tax rate for middle-class families among large U.S. metros at just 9.6%. Families of 4 earning $97,875 — the estimated pretax income needed for a modest standard of living — pay $9,357 in federal and state income taxes annually. This light tax burden is largely due to Texas’s lack of a state income tax, which significantly reduces overall taxes.

Houston ranks a close second, also with a 9.6% tax rate. Middle-class families there pay $9,425 on a pretax income of $98,033. Like San Antonio, Houston benefits from the absence of state income tax, which allows families to retain more of their earnings relative to similar metros in higher-tax states.

Memphis, Tennessee, ranks third with a 9.9% effective tax rate. Families earning $93,949 pay $9,310 in annual taxes. Tennessee, like Texas, also does not have an individual income tax, which helps keep tax burdens low for families across the income spectrum.

The rest of the bottom 10 is dominated by metros in other no-income-tax states, including Dallas, Nashville, Jacksonville, Tampa, Las Vegas, and Orlando. Tucson, Arizona, is the only metro in the bottom 10 located in a state that does impose an income tax, though at a relatively low rate. Middle-class families in these cities benefit not only from the absence of (or low) state income taxes but also from generally lower living costs, which reduce the income required to maintain a modest standard of living. As a result, these households face smaller tax bills both in absolute terms and as a share of their income.

Mapped: Middle-Class Tax Rates by State

State-level tax burdens for middle-class families largely mirror the patterns seen at the metro level, with the highest effective rates concentrated along the West Coast and in the Northeast. Hawaii tops the list with an effective tax rate of 17.5%, followed closely by New York, Connecticut, and Massachusetts — all states with relatively high living costs and progressive income tax structures. California also ranks high, at 16.4%.

At the other end of the spectrum, the lowest effective tax rates are concentrated in states with low or no personal income tax. Tennessee and North Dakota tie for the lowest burden at 9.2%, with South Dakota, Texas, Wyoming, and Florida also among the most tax-friendly for middle-class families. In many of these states, lower living costs combined with the absence of a state income tax result in comparatively low pretax income requirements and smaller tax bills overall.

Here is a summary of the data for Georgia:

-

Middle-class effective tax rate: 13.4%

-

Middle-class annual taxes: $13,723

-

Middle-class family income (post-tax): $88,704

-

Middle-class family income (pre-tax): $102,427

For reference, here are the statistics for the entire United States:

-

Middle-class effective tax rate: 13.6%

-

Middle-class annual taxes: $15,522

-

Middle-class family income (post-tax): $113,804

-

Middle-class family income (pre-tax): $98,281

For the full report: upgradedpoints.com